Moody corporation uses a job-order costing system – Moody Corporation’s adoption of a job-order costing system serves as a captivating case study, offering a profound understanding of how organizations meticulously track and allocate costs in a dynamic manufacturing environment. As we delve into the intricacies of this system, we uncover the key principles, processes, and implications that drive accurate cost determination and informed decision-making within Moody Corporation.

The job-order costing system, a cornerstone of Moody Corporation’s accounting practices, provides a granular view of costs associated with each unique production order. This granular approach enables the company to pinpoint the profitability of specific jobs, optimize resource allocation, and gain invaluable insights into the efficiency of its manufacturing processes.

Company Overview

Moody Corporation is a manufacturing company that produces a wide range of products, including electronics, appliances, and machinery. The company operates in a highly competitive industry, where it faces intense competition from both domestic and international manufacturers.

To remain competitive, Moody Corporation has implemented a job-order costing system. This system allows the company to track the costs associated with each individual job or project, which helps it to price its products accurately and manage its costs effectively.

Job-Order Costing System

Job-order costing is a method of costing that is used by companies that produce products or services on a custom or one-time basis. This system allows companies to track the costs associated with each individual job or project, which helps them to price their products accurately and manage their costs effectively.

The job-order costing process typically involves the following steps:

- When a customer places an order, the company creates a job cost sheet for the order.

- As the job progresses, the company tracks the direct materials, direct labor, and overhead costs that are incurred.

- When the job is complete, the company calculates the total cost of the job and transfers the cost to the cost of goods sold.

Cost Accumulation: Moody Corporation Uses A Job-order Costing System

The first step in the job-order costing process is to accumulate the costs associated with each job. These costs can be classified into three categories: direct materials, direct labor, and overhead costs.

- Direct materialsare the materials that are used directly in the production of a product. For example, the wood that is used to make a table is a direct material.

- Direct laboris the labor that is directly involved in the production of a product. For example, the labor that is used to assemble a table is direct labor.

- Overhead costsare the costs that are incurred in the production of all products, but cannot be directly traced to a specific job. For example, the cost of rent for the factory is an overhead cost.

Job Costing Records

The job cost sheet is the primary document that is used to track the costs associated with each job. The job cost sheet typically includes the following information:

- The job number

- The customer name

- The product description

- The quantity ordered

- The unit price

- The total cost of the job

Overhead Allocation

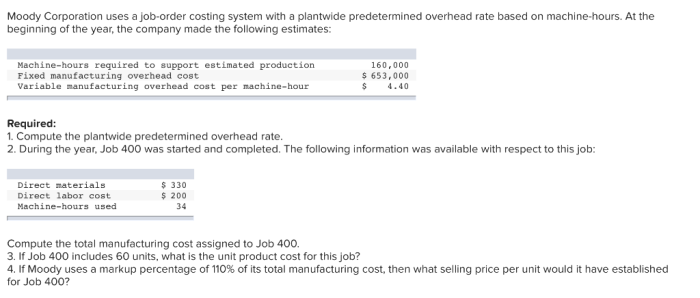

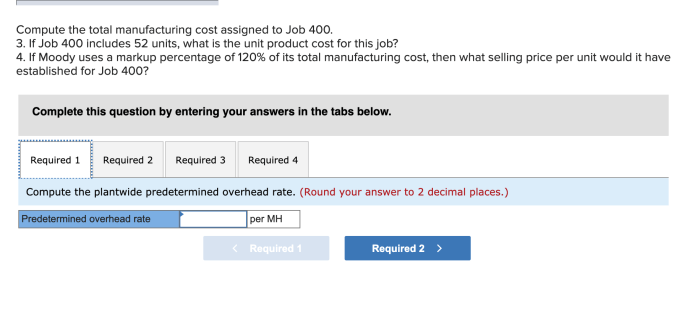

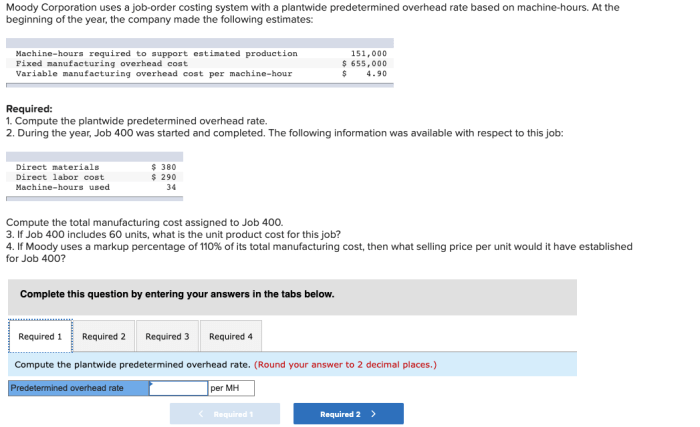

Overhead costs are allocated to jobs using a variety of methods. The most common method is the predetermined overhead rate. The predetermined overhead rate is calculated by dividing the estimated total overhead costs for a period by the estimated total activity level for the period.

Once the predetermined overhead rate has been calculated, it can be used to allocate overhead costs to jobs. The amount of overhead costs that is allocated to a job is equal to the predetermined overhead rate multiplied by the amount of activity that is performed on the job.

Job Completion and Cost of Goods Sold

When a job is complete, the total cost of the job is transferred to the cost of goods sold. The cost of goods sold is the total cost of the products that have been sold during a period. The cost of goods sold is used to calculate the company’s gross profit.

Key Questions Answered

What is the primary purpose of a job-order costing system?

A job-order costing system provides detailed cost information for specific production orders, enabling companies to assess the profitability of individual jobs and optimize resource allocation.

How does Moody Corporation accumulate costs in its job-order costing system?

Moody Corporation accumulates costs in three primary categories: direct materials, direct labor, and overhead costs. These costs are meticulously assigned to each job order based on actual usage or predetermined rates.

What is the significance of job cost sheets in a job-order costing system?

Job cost sheets serve as central repositories for all costs associated with a specific job order. They provide a comprehensive record of materials, labor, and overhead costs, facilitating accurate cost tracking and analysis.